Distressed Assets

Distressed Assets

Property Investments,

Sourcing and Off-Market Deals

Astute property investors buy distressed assets because that is where you find value.

There are very few property deals in estate agents' windows or on Rightmove and Zoopla, but that is where retail investors and amateurs acquire property.

Wholesale investors, predominantly professionals, buy distressed assets at auction, genuine off-market properties, and through receivers and administrators. The price difference can be up to 50%. The numbers are significant, and once you have invested wholesale, you will not go back to overpaying in the retail market.

Distressed Assets can help you.

We have been buying and sourcing distressed assets since the Credit Crunch and financial crisis of 2008. You will see some examples in our Amazon No.1 bestselling book. We do this almost exclusively through property auctions, as it is the best and most transparent approach for buying genuine below-market-value properties with further potential to add value, either by managing up rents, developing, or Buying, Refurbishing, Refinancing, and Renting (BRRR).

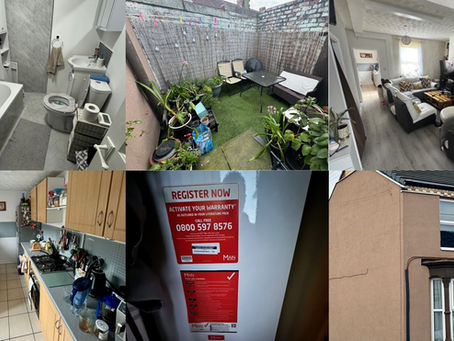

We also have access to genuine and exclusive off-market property deals, examples you will see on this site.

We do this for ourselves and our clients.

Recent Property Auctions

Recent Off-Market Acquisitions

Property Auctions and Distressed Assets Investment Workshops

Upcoming Events

Distressed Assets runs a series of property investment courses in London and Liverpool to train new and experienced property investors on how to source and invest in below-market-value properties. In addition to the LIVE in-person events, these training workshops are now also available LIVE via the Internet for those wishing to participate from home.

Property Auctions and Distressed Assets One-Day Intensive CourseSat 28 MarLondon and LIVE ONLINE

Property Auctions and Distressed Assets One-Day Intensive CourseSat 28 MarLondon and LIVE ONLINE

We specialise in bank repossessed properties, developers that have gone bankrupt, and general problem properties which we can fix, thereby adding significant value. We also provide property investment courses and consultancy service and can assist you source properties across the United Kingdom.

Please have a read of the website and if you have any questions or wish to learn more about how we can help you, then please contact us

Many of you will be visiting this website because you have bought the book:

Property Auctions: Repossessions, Bankruptcies and Bargain Properties: The Expert's Guide to Success in all Market Conditions 3rd Edition 2025

Many thanks.

To be added to our distressed assets mailing list, please enter your details below.

It would also be helpful to drop me an e-mail with any types of property, such as development opportunities or standard buy to let which may be of interest and also the location. We can help you throughout the UK.

Our Services

Property Sourcing

We identify, research and inform you of bargain properties that can be bought significantly below market value. These properties in the main have been repossessed by banks. Others may have issues such as a missing freeholder, under rented or a corporate selling due to reducing leverage (or borrowings).

We also have access to frequent off-market deals, which are not available elsewhere.